Pet Insurance Cost for Cats: What to Expect and How to Choose the Best Plan

For cat owners, ensuring their feline companions receive the best care possible is a top priority. One way to achieve this is by investing in pet insurance. With the rising cost of veterinary care, having an insurance plan tailored to your cat’s needs can save you from unexpected expenses and provide peace of mind. This article explores the cost of pet insurance for cats, essential coverage options, tips for selecting the right plan, and top insurance providers in the United States.

Understanding Pet Insurance Costs for Cats

The cost of pet insurance for cats varies depending on several factors:

1. Breed

Certain cat breeds are predisposed to specific health issues, which can influence insurance premiums. For example:

- Persian cats: Prone to respiratory and kidney issues.

- Maine Coons: At risk for heart conditions like hypertrophic cardiomyopathy.

2. Age

Kittens and young cats generally have lower premiums compared to older cats. As cats age, they are more likely to develop chronic conditions, which increases the cost of insurance.

3. Location

Your geographic location impacts veterinary costs, which directly affect insurance premiums. Urban areas typically have higher costs than rural regions.

4. Coverage Type

Insurance plans range from basic accident-only coverage to comprehensive policies covering routine care, illnesses, and wellness checkups.

Average Monthly Costs

- Accident-Only Coverage: $10-$20

- Accident and Illness Coverage: $20-$40

- Comprehensive Coverage: $40-$70+

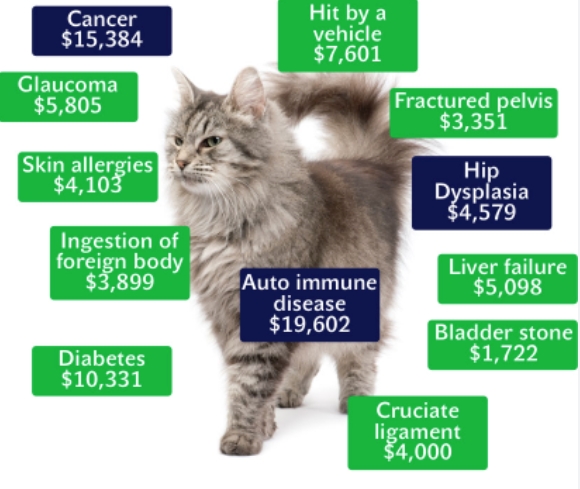

Essential Pet Insurance Coverage for Cats

When choosing a pet insurance plan, it’s important to prioritize coverage that addresses the most common health needs for cats. Key coverage options include:

1. Accident Coverage

Covers unexpected events such as injuries, fractures, or poison ingestion.

2. Illness Coverage

Includes treatment for illnesses like urinary tract infections, diabetes, and cancer.

3. Wellness Coverage

Optional add-on coverage for routine care, such as vaccinations, flea prevention, and dental cleaning.

4. Chronic Conditions

Covers ongoing conditions like arthritis or hyperthyroidism that require continuous management.

5. Emergency and Specialty Care

Provides coverage for visits to emergency clinics and specialized treatments, such as surgeries or diagnostic tests.

How to Choose the Right Pet Insurance Plan

Selecting the best pet insurance for your cat requires careful evaluation of various factors. Here’s a step-by-step guide:

1. Assess Your Cat’s Needs

- Consider your cat’s age, breed, and medical history.

- Younger cats might benefit from wellness coverage, while older cats may require plans that cover chronic conditions.

2. Compare Coverage and Exclusions

- Ensure the plan covers a wide range of conditions, including hereditary and congenital issues.

- Be aware of exclusions, such as pre-existing conditions or breed-specific restrictions.

3. Evaluate Reimbursement and Deductibles

- Reimbursement Rates: Commonly range from 70% to 90% of eligible costs.

- Deductibles: Choose between annual or per-incident deductibles based on your budget and expected veterinary expenses.

4. Check Claim Processing Times

Research how quickly the insurer processes claims and reimburses policyholders.

5. Use Online Tools

Many insurers provide online calculators to estimate premiums based on your cat’s details.

Top Pet Insurance Providers for Cats in the U.S.

1. Healthy Paws

- Coverage: Accidents, illnesses, hereditary conditions, and alternative therapies.

- Cost: $25-$50/month.

- Pros: Unlimited lifetime benefits, no caps on claims.

- Cons: No wellness coverage.

2. Trupanion

- Coverage: Comprehensive coverage with optional wellness add-ons.

- Cost: $30-$75/month.

- Pros: Direct vet payment option, 90% reimbursement.

- Cons: Higher premiums.

3. ASPCA Pet Health Insurance

- Coverage: Accidents, illnesses, dental care, and optional wellness add-ons.

- Cost: $20-$50/month.

- Pros: Flexible plans, covers exam fees.

- Cons: Annual coverage limits.

4. Nationwide

- Coverage: Comprehensive plans, including coverage for exotic pets.

- Cost: $25-$60/month.

- Pros: Broad coverage options, wellness add-ons available.

- Cons: Coverage limits based on age.

5. Figo

- Coverage: Accidents, illnesses, hereditary conditions, and optional wellness.

- Cost: $20-$60/month.

- Pros: 100% reimbursement option, cloud-based pet health management.

- Cons: Limited wellness coverage.

Tips for Getting the Most Out of Pet Insurance

1. Enroll Early

Signing up when your cat is young and healthy can help you avoid exclusions for pre-existing conditions.

2. Keep Detailed Medical Records

Maintaining accurate records of your cat’s health history can make the claims process smoother.

3. Review Policies Annually

Reevaluate your plan each year to ensure it still meets your needs and budget.

4. Consider Multi-Pet Discounts

If you have more than one pet, look for insurers that offer discounts for multiple policies.

5. Budget for Upfront Costs

Most plans require you to pay vet bills upfront and get reimbursed later. Having an emergency fund can help cover initial expenses.

Conclusion

Investing in pet insurance for your cat is a proactive way to ensure their health and well-being. By understanding the costs, coverage options, and top providers, you can select a plan that suits your cat’s needs and your financial situation. With the right insurance, you can focus on providing the best care for your feline friend, knowing that unexpected veterinary bills won’t disrupt your peace of mind.